RRSP Benefits

A Registered Retirement Savings Plan (RRSP) is a vehicle to help Canadians to save for retirement.

Primary Benefits of an RRSP

1. Can reduce the overall taxes you pay

2. Can increase the government benefits you receive

3. Investments can grow without paying taxes on dividends and capital gains until you withdraw the money in retirement.

The focus of the calculator at rrspcontribution.ca is on numbers 1 and 2 above.

RRSP Benefit #1: Reduce the Overall Taxes you Pay

In order to understand benefit #1, it is important to understand the marginal tax rate system used in Canada. The marginal tax rate is the tax rate you pay on each additional dollar of income, and that rate tends to increase at higher income levels. An example of a marginal tax rate structure is in the table below, where each row is a ‘tax bracket.’

| Income Level | Income Tax Rate |

|---|---|

| $0 - $40,000 | 15% |

| $40,001 - $70,000 | 20% |

| $70,001 to $100,000 | 25% |

| $100,001 to $150,000 | 30% |

| Greater than $150,000 | 35% |

Example 1: Income is $50,000

For the first $40,000 of your income, you are paying 15% in income tax. However, for the amount over that, up to your $50,000 income, you are paying the higher rate of 20%. The table below shows how to calculate the total taxes owed.

| Income Level | Income Tax Rate | Calculation | Income Tax Amount |

|---|---|---|---|

| $0 - $40,000 | 15% | $40,000 * 0.15 | $6,000 |

| $40,001 - $70,000 | 20% | ($50,000 - $40,000) * 0.20 | $2,000 |

| $70,001 to $100,000 | 25% | - | - |

| $100,001 to $150,000 | 30% | - | - |

| Greater than $150,000 | 35% | - | - |

| Total | $8,000 |

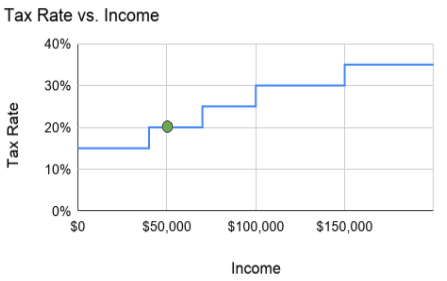

We can look at the federal tax rate on a chart as well, with the green dot the $50,000 income we just discussed.

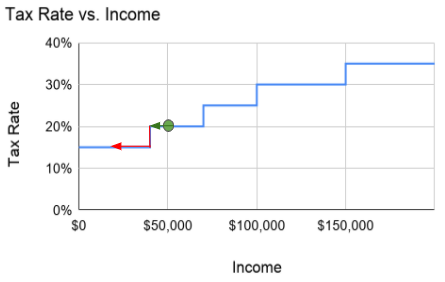

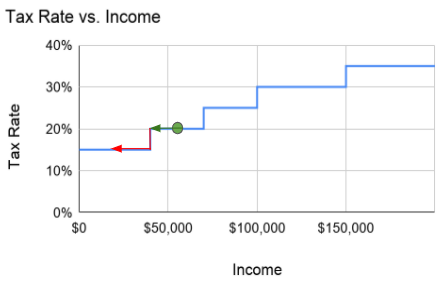

Now that we’ve reviewed marginal tax rates, let’s look at how RRSP can reduce the overall taxes you pay. When you contribute to your RRSP, you can then use that to make a deduction against your income. When you reduce your income, you reduce the taxes you owe. If we look at the tax rate chart again, the green arrow is showing the reduction in income where we were paying 20% tax, which we no longer need to pay now. This will result in either less tax owed when filing your taxes, or a larger tax refund, depending on how much tax you already paid throughout the year. However, let’s look at what happens after we make more than a $10,000 reduction in our income. We now go over the cliff, and along the red arrow. Here, for every dollar we reduce our income, we are only getting 15% back, so less than before. When deciding how much to contribute to your RRSP, you need to consider where these cliffs are, and if it makes sense to go over one or not. The calculator used at rrspcontribution.ca looks for these cliffs and gives considerations based on this.

Example 2: Income increases to $55,000 (same tax bracket)

Let’s take a look at what happens when our income increases. Maybe we’ve had a great year at work and are expecting a big 10% raise to be coming our way, taking our income to $55,000. Let’s look at what that means for our potential RRSP contribution the following year. Notice that the green line is now longer than before, meaning that we can get the higher 20% reduction in our income for the first $15,000 of our RRSP contribution, compared to $10,000 the previous year, before hitting the cliff.

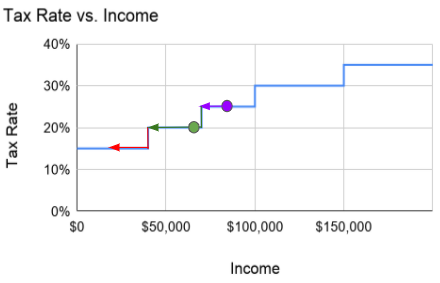

Example 3: Income increases to $68,000 (close to a new tax bracket)

Let’s look a few years out now, and assume our income is up to $68,000, shown by the green dot below. If we look at the chart, we see that there is a step up at $70,000 where the tax rate becomes 25%. Although we now have a long runway for our RRSP where we get the 20% back (green arrow) and stay away from the cliff to 15%, we need to consider if our income will pass $70,000 soon. If it does increase, we can now start to get 25% of our contribution back for a portion of it, as shown with the purple dot and arrow below. If we expect to go up this step soon, we may want to save some of our RRSP room for future years as we move further up the 25% level.

Another key aspect of RRSPs is that when you withdraw that money from your RRSP when you retire, it counts as income and therefore you may need to pay taxes on it then. If you are early in your career, it is possible that your income now will actually be lower than your income in retirement, in which case the tax savings you get now may actually be less than the tax you need to pay on the income when you retire. In that situation, you may want to consider delaying using your RRSP room to reduce your income until you enter a higher tax bracket.

Key Takeaways

The key takeaways to think about on taking advantage of an RRSP’s benefit of reducing the overall taxes you pay are:

1. Are there any ‘cliffs’ in your tax reduction to consider not wanting to go over this year and wait to use a portion of the room another year.

2. Are there any ‘steps’ in your tax reduction coming up, where you can get an even higher reduction in your taxes owed, and want to ensure you have room for future years to take advantage of that.

3. Are you at a point in your career where your income may be lower than in retirement, and it makes sense to wait until your income increases before taking advantage of an RRSP contribution and deduction from your income.

RRSP Benefit #2: Increase the government benefits you receive

There are many government benefits that are income tested, which means that the amount of the benefit you receive depends on your income. In many cases, the income amount the government uses is your net income, which accounts any RRSP deductions you have made. As an example, if your gross income was $60,000, but you made a $10,000 contribution to your RRSP and used the full amount to deduct from your income, your net income would become $50,000.

Example 1: Canada Child Benefit (CCB)

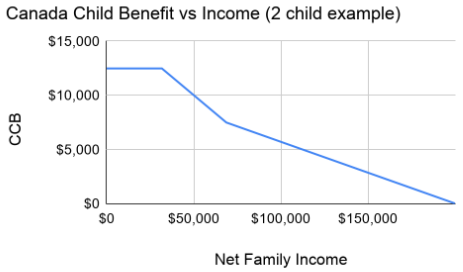

One government benefit that uses your net income (and your spouse’s net income, if applicable) is the Canada Child Benefit. You can get a government benefit of approximately $7,000 per child under the age of 6 and approximately $6,000 per child under the age of 18. However, as your income increases, the government claws back (reduces) the amount of the benefit you receive, and it eventually becomes $0.

The chart below shows an example of the Canada Child Benefit received for a family with one child under 6 and another child between 6 and 17, and how it varies with Adjusted Net Family Income. It is using 2020 numbers.

At a net income of less than approximately $31,000, you will receive the full Canada Child Benefit. However, income between $31,000 and $68,000, your CCB is reduced by 13.5% of every dollar you earn in that range. For example, if your income was $41,000, your CCB would be clawed back (reduced) by $1,350, which is 13.5% of $41,000-$31,000. Therefore, if you can reduce your net income with your RRSP contribution, it can reduce the clawback and you will receive a larger CCB. Above approximately $68,000, your CCB is reduced by 5.7% of any additional income you earn, until it becomes $0. In this example, it becomes $0 at an net family income of approximately $200,000. For someone with an income slightly above $200,000, they would be able to use an RRSP contribution to reduce their income and start to get a portion of the CCB again.

The calculator at rrspcontribution.ca takes into account the CCB and gives considerations for your RRSP contribution based on it.

Example 2: Canada Recovery Benefit (CRB)

The Canada Recovery Benefit (CRB) is another example of a Canadian government benefit that is income tested. For more information on the CRB, go here.

The calculator at rrspcontribution.ca takes into account the CRB and gives considerations for your RRSP contribution based on it.