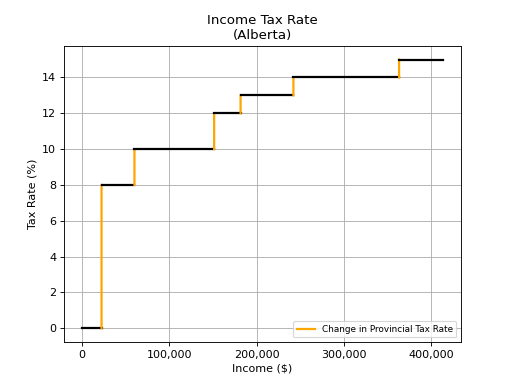

Alberta Income Tax Rates

Alberta provincial tax rates are below in chart and tables formats. You can use the form below to select a tax year and optionally combine the federal tax rates with the provincial tax rates. The Basic Personal Amount for the tax types you select will be included by default.

There are also many government benefits that are income tested, meaning that as your income increases, the amount of the benefit you receive decreases. This is effectively the same as paying additional tax. To include the impact of government benefits in the tax, use the Effective Tax Rate Calculator.

| Income | Tax Rate | Reason for Change |

|---|---|---|

| $0 to $22,323 | 0.0% | Basic Personal Amount |

| $22,323 to $60,000 | 8.0% | Provincial Basic Personal Amount => End of tax credit (+8.0%) |

| $60,000 to $151,234 | 10.0% | Provincial Tax => Change in rate (+2.0%) |

| $151,234 to $181,481 | 12.0% | Provincial Tax => Change in rate (+2.0%) |

| $181,481 to $241,974 | 13.0% | Provincial Tax => Change in rate (+1.0%) |

| $241,974 to $362,961 | 14.0% | Provincial Tax => Change in rate (+1.0%) |

| $362,961 and above | 15.0% | Provincial Tax => Change in rate (+1.0%) |

The information on this site is for informational purposes only and is not intended to be a substitute for professional advice. Please see the legal disclaimer for more information.